In the fast-paced and dynamic world of forex trading, options have emerged as one of the most versatile financial instruments that traders can utilize to enhance their strategies. Whether you’re a seasoned trader or just starting, understanding the intricacies of forex options trading can significantly improve your chances of success. In this article, we’ll delve into effective strategies for trading forex options, providing you with the insights needed to navigate this exciting market. For further reading, you might find forex options trading strategy trading-connexion.com a useful resource.

Understanding Forex Options

Forex options give traders the right but not the obligation to buy or sell a currency pair at a predetermined price on or before a specified date. Unlike regular forex trades that involve direct ownership of currencies, options allow traders to manage risk more effectively and execute strategies with various risk/reward profiles. This unique characteristic makes them particularly appealing to those looking to diversify their trading approaches.

Key Concepts in Forex Options Trading

Before diving into strategies, it’s essential to grasp some fundamental concepts related to forex options:

- Strike Price: This is the price at which the options contract can be exercised.

- Expiration Date: This is the date by which the option must be exercised or it becomes worthless.

- Premium: The cost of purchasing the option, paid upfront by the buyer to the seller.

- Call and Put Options: A call option gives the buyer the right to purchase, while a put option grants the right to sell a currency pair.

Effective Forex Options Trading Strategies

Now that you have a foundational understanding of forex options, let’s explore some trading strategies that can help you leverage options effectively:

1. Hedging with Options

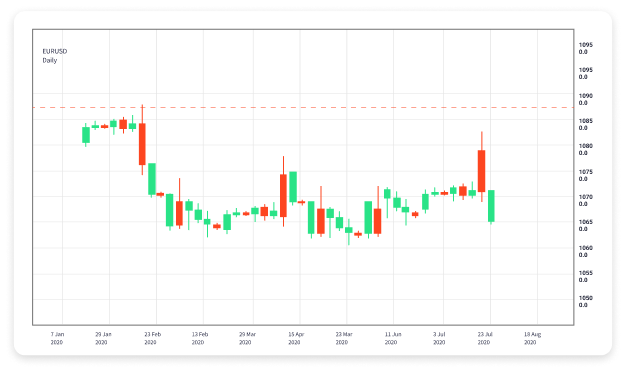

One of the primary uses of forex options is hedging against potential losses in your forex positions. For example, if you hold a long position in EUR/USD and anticipate potential downward movement in the euro, you can purchase a put option to protect your investment. If the euro depreciates, the gains from the put option can offset the losses from the forex position, providing a safety net for your investment.

2. Straddles and Strangles

Straddles and strangles are strategies designed to capitalize on volatility. A straddle involves buying a call and a put option at the same strike price and expiration date, allowing you to profit from significant price movements in either direction. A strangle, on the other hand, consists of buying a call and a put option with different strike prices but the same expiration date. These strategies are particularly effective during periods of market uncertainty or ahead of major economic announcements.

3. Covered Calls

If you’re holding a long position in a currency pair and are willing to cap your potential gains, consider using a covered call strategy. In this approach, you sell call options on the currency pair you already own, generating income from the premium received. This strategy works best in sideways or mildly bullish markets when you anticipate limited price movement.

4. Iron Condors

The iron condor strategy involves selling a lower strike put option and a higher strike call option while simultaneously buying a lower strike call option and a higher strike put option. This strategy is designed to profit from low volatility and works optimally in markets where you expect limited price movement. The goal is to have the currency pair stay within a defined range, allowing all options to expire worthless, and keeping the premium as profit.

5. Calendar Spreads

A calendar spread involves buying and selling options at the same strike price but with different expiration dates. This strategy can be beneficial when you anticipate volatility in the short term but expect the underlying currency pair to stabilize over a longer horizon. By selling the short-term option and buying the longer-term option, you can capitalize on the time decay of the options premium.

Risk Management in Forex Options Trading

Implementing effective risk management techniques is crucial for success in forex options trading. Here are some essential tips:

- Determine Position Size: Always adjust your position size based on your risk tolerance and account size.

- Set Stop-Loss Orders: Protect your capital by setting stop-loss orders on all trades.

- Diversify Your Portfolio: Don’t put all your capital into a single currency pair or strategy. Diversification can help mitigate risk.

Conclusion

Forex options trading offers traders a wealth of opportunities to enhance their trading strategies and manage risk effectively. By utilizing the strategies outlined above—such as hedging, straddles, and iron condors—you can improve your trading outcomes in the volatile forex market. Always remember that risk management is key, and continued education and practice are essential for long-term success. As you venture into forex options trading, harness the flexibility these instruments offer and stay informed about market developments to make the most of your trading endeavors.