In today’s fast-paced financial market, having a reliable online forex trading platforms Trading Platform BD is essential for successful forex trading. With the rising popularity of forex trading, numerous platforms have emerged, each offering unique features and tools aimed at traders of all experience levels. This article aims to provide an in-depth overview of online forex trading platforms, their advantages, how to select the right one, and tips for enhancing your trading experience.

Understanding Forex Trading Platforms

Forex trading platforms are software applications that allow traders to access the foreign exchange market. They provide features for executing trades, analyzing market data, and managing trading accounts. These platforms can be desktop-based, web-based, or mobile applications, catering to the diverse needs of traders. The choice of platform can significantly impact a trader’s efficiency, profitability, and overall trading experience.

Key Features of Online Forex Trading Platforms

When evaluating online forex trading platforms, it’s important to consider several key features that can influence your trading performance:

User Interface and Experience

A user-friendly interface is crucial for both novice and experienced traders. A well-designed platform with intuitive navigation can facilitate faster trade execution and decision-making. Look for customizable layouts that allow you to organize your workspace according to your preferences.

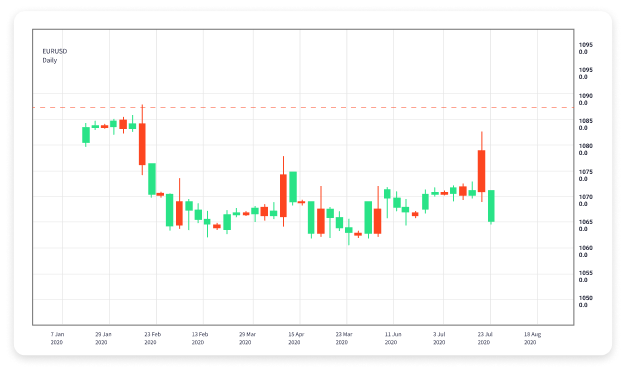

Comprehensive Charting Tools

Effective technical analysis relies on sophisticated charting tools. Many platforms offer various types of charts (line, bar, candlestick) and indicators (moving averages, RSI, MACD) that help traders analyze market trends and make informed decisions. Ensure that the platform you choose provides the necessary tools for your trading strategy.

Order Types and Execution Speed

Different trading strategies require different order types. A good trading platform should offer various order types, including market orders, limit orders, stop-loss orders, and trailing stops. Additionally, the execution speed is critical – delays in order execution can lead to missed opportunities or increased losses.

Access to a Wide Range of Assets

While forex trading is the primary focus, having access to additional assets such as commodities, cryptocurrencies, and stocks can enhance your trading portfolio. Many platforms offer a diverse selection of trading instruments, allowing you to diversify your risk.

Educational Resources and Support

For beginners, educational resources such as tutorials, webinars, and demo accounts are invaluable for learning the ropes of forex trading. Furthermore, reliable customer support should be readily available to assist with any issues or questions that arise during the trading process.

Types of Forex Trading Platforms

Forex trading platforms generally fall into three categories: desktop platforms, web-based platforms, and mobile applications. Each type has its pros and cons:

Desktop Platforms

Desktop platforms are installed on a user’s computer and often provide the most robust features, including advanced charting tools and technical analysis capabilities. They are suitable for serious traders who need comprehensive functionality. However, they require a stable internet connection and might not offer flexibility for traders on the go.

Web-Based Platforms

Web-based platforms are accessible through a web browser, which means they do not need to be downloaded or installed. They are highly convenient for traders who prefer trading from multiple devices. However, some web-based platforms may lack the advanced features of desktop options.

Mobile Applications

Mobile trading apps are perfect for those who want to trade on-the-go. They offer core functionalities that allow users to monitor the market and execute trades directly from their smartphones or tablets. While they provide convenience, mobile apps may have limited features compared to full desktop platforms.

How to Choose the Right Forex Trading Platform

Selecting the right forex trading platform depends on your personal trading preferences, experience level, and specific needs. Here are some tips to help you make an informed decision:

Assess Your Trading Style

Your trading style – whether day trading, swing trading, or long-term investing – will influence the platform’s features you prioritize. For instance, day traders may require fast execution speeds and advanced charting tools, while long-term investors may prioritize ease of use and educational resources.

Check Regulation and Security

Ensure that the platform is regulated by a recognized authority. Regulatory bodies enforce standards and guidelines aimed at protecting traders. In addition, look for advanced security measures like encryption technologies to safeguard your personal and financial information.

Read Reviews and Compare Platforms

Before settling on a platform, read user reviews and feedback to gauge the experiences of other traders. Additionally, it’s wise to compare different platforms side by side, paying attention to features, fees, and overall user experience.

Utilize Demo Accounts

Many forex trading platforms offer demo accounts, allowing you to test their features, tools, and overall usability without risking real money. Take advantage of this opportunity to gauge whether a platform suits your trading needs before committing financially.

The Future of Online Forex Trading Platforms

As technology evolves, so will online forex trading platforms. Trends like artificial intelligence (AI), machine learning, and automated trading systems are expected to become increasingly prevalent. These advancements will likely enhance trading precision, speed, and analytics, making forex trading more accessible and efficient for everyone.

Conclusion

Online forex trading platforms are indispensable tools for traders looking to navigate the complexities of the foreign exchange market. By understanding the key features, types of platforms, and how to choose the right one, you can significantly improve your trading journey. As the industry continues to evolve, remaining informed about new features and enhancements will ensure that you stay ahead in the ever-competitive forex landscape.